This week, Cathie Wood’s ARK Invest fund made a profitable move with COIN stock. On Tuesday, ARK sold 160,887 shares of COIN for $13.5 million when the stock was at approximately $83 a share. Just two days later, ARK bought the dip and purchased 268,928 shares of COIN as the stock fell and closed Thursday in the U.S at $66.30. This savvy move by ARK Invest resulted in a profitable gain for the fund. This is yet another example of ARK Invest’s ability to capitalize on market opportunities and make smart investments.

Coinbase, the leading cryptocurrency exchange, recently disclosed that it received a Wells Notice from the Securities and Exchange Commission (SEC). This notice warns Coinbase that the SEC is planning to take enforcement action against it. In the two days following the notice, Coinbase sold 269,928 of its shares, with 230,599 going to ARK Innovation ETF (ARKK) and 38,329 to the ARK Next Generation Internet ETF (ARKW). This news has caused some concern among investors, as the SEC’s enforcement action could have a significant impact on Coinbase’s future.

The U.S. Securities and Exchange Commission (SEC) has issued a Wells Notice to Coinbase, indicating that the SEC believes there is substantial evidence to warrant enforcement action. Coinbase has until March 29 to decide if it will contest the enforcement action. The SEC has also filed a lawsuit against Justin Sun, the Tron Foundation, the BitTorrent Foundation, Rainberry (formerly BitTorrent), and internet personality Jake Paul for allegedly selling unregistered securities and manipulating the market through wash trading. The lawsuit is part of the SEC’s ongoing effort to protect investors and ensure that the crypto market is free from fraud and manipulation.

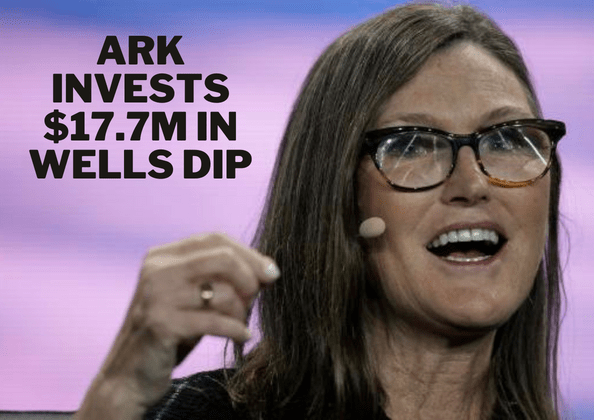

Coinbase CEO Brian Armstrong recently announced that the company will be getting more politically involved and encouraging its U.S.-based users to elect “pro-crypto candidates”. He encouraged users to contact their congressman, donate to pro-crypto candidates, show up at town halls, and make their voices heard. Coinbase is hoping to ensure its success by electing pro-crypto candidates in the U.S. Despite the Wells-induced dip, Coinbase’s stock (COIN) is still up 97% year-to-date. ARK Investment Management has also purchased 320,557 shares of Block (SQ), with 275,554 of these shares going to ARKK. Coinbase is taking a proactive approach to ensure its success by encouraging its users to elect pro-crypto candidates.

Jack Dorsey’s fintech payments company, Square, has seen a 14% drop in its stock price after a scathing report from short-seller Hindenburg Research accused the company of “”wildly”” overstating user counts. Square has responded to the report, denying its accuracy and stating that it intends to work with the SEC and explore legal action against Hindenburg Research. Square is a payments company with some crypto exposure, and its stock price has been affected by the report. Investors should be aware of the potential risks associated with investing in Square.