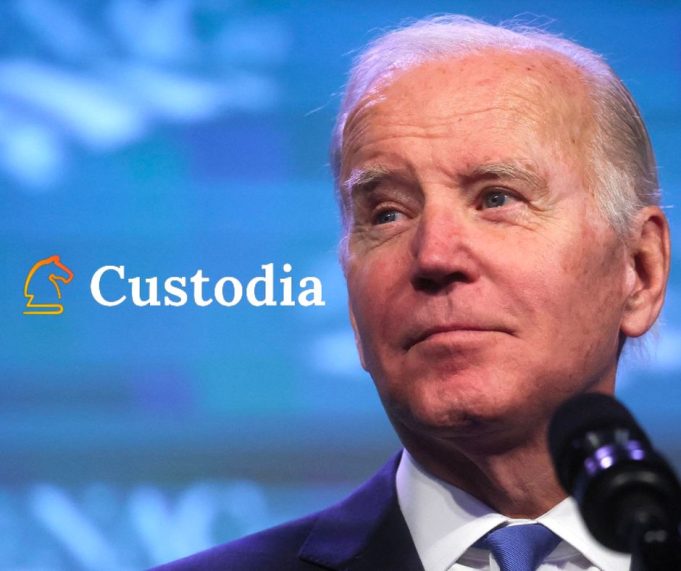

Custodia Bank CEO Caitlin Long has claimed that factions in the Biden administration and the U.S. Federal Reserve were responsible for scuttling the bank’s efforts to obtain a master account from the central bank. Long told CoinDesk TV’s “First Mover” that crypto is here to stay and regulators will have to deal with it. She said that if the anti-crypto faction thinks that crypto is going to go away, they will be playing whack-a-mole for years down the road. Long’s comments come as Custodia Bank’s efforts to obtain a master account from the Federal Reserve have been scuttled by factions in the Biden administration and the U.S. Federal Reserve. Despite this, Long is confident that crypto is here to stay and regulators will have to deal with it.

Caitlin Long, a crypto-friendly legislator from Wyoming, recently warned federal regulators about a crypto company she believes is engaging in fraud. Despite her efforts, she claims her warning fell on deaf ears. Long and her team at Custodia have been trying to educate bank regulators on the risks and potential benefits of crypto-related technologies for the past two and a half years. She believes that the regulators need to be more aware of the potential risks and rewards of the crypto industry in order to protect investors and ensure the industry’s growth.

Custodia Bank, a three-year-old special purpose depository institution in Wyoming, has been denied membership in the Federal Reserve system and a “master account” application by the Kansas City Fed. This has raised questions about the independence of the Federal Reserve from the White House and the Kansas City Reserve Bank from the Federal Reserve Board. The central bank denied Custodia’s bid for Federal Reserve system membership citing concerns about the “safety and soundness” of the bank. The bank has been trying to push its way into the U.S. banking system for the past three years. The decision has been met with criticism from the bank and its supporters.

Custodia, a Cheyenne-based cryptocurrency firm, recently had its application for a master account denied by the Wyoming Division of Banking. This denial has sparked a debate about the regulation of cryptocurrencies and whether they should be regulated or remain outside of the regulated financial system. The U.S. Securities and Exchange Commission (SEC) has taken extensive action against other crypto-native firms, including Kraken and Paxos, in the wake of the Custodia application denial. This has raised questions about the future of cryptocurrency regulation in the U.S. and whether the SEC will continue to take a hard stance against crypto-native firms. It remains to be seen how the SEC will respond to Custodia’s renewed push for a master account.

Regulators in the U.S. have been taking action against the crypto industry, pushing crypto companies needing funding to banks outside the U.S. According to crypto industry veteran, Robert Long, light needs to be shown on why politicians got involved with a company that wasn’t even operating yet and why Custodia Bank was chosen as the sacrificial lamb. CoinDesk reached out for comment from regulators including the SEC and Fed, but all declined to comment. This has raised questions about the motives behind the regulators’ actions and the potential implications for the industry.